owe state taxes from unemployment

You can find the amount you withheld during 2020 in Box 4 on the 1099-G tax form you shouldve received from EDD. Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes.

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

Yes you can owe taxes on unemployment payments because unemployment is taxable income.

. In every other state unemployment benefits are treated as regular income. The usual reason for owing state tax is that you did not have enough withheld from your paychecks---or perhaps from your unemployment. Unemployment Insurance UI tax and Employment Training Tax ETT are calculated up to the UI taxable wage limit of each employees wages per year and are paid by.

The IRS considers unemployment benefits taxable income When filing this spring your unemployment checks. Check all of the data you. Do you have to pay taxes on unemployment.

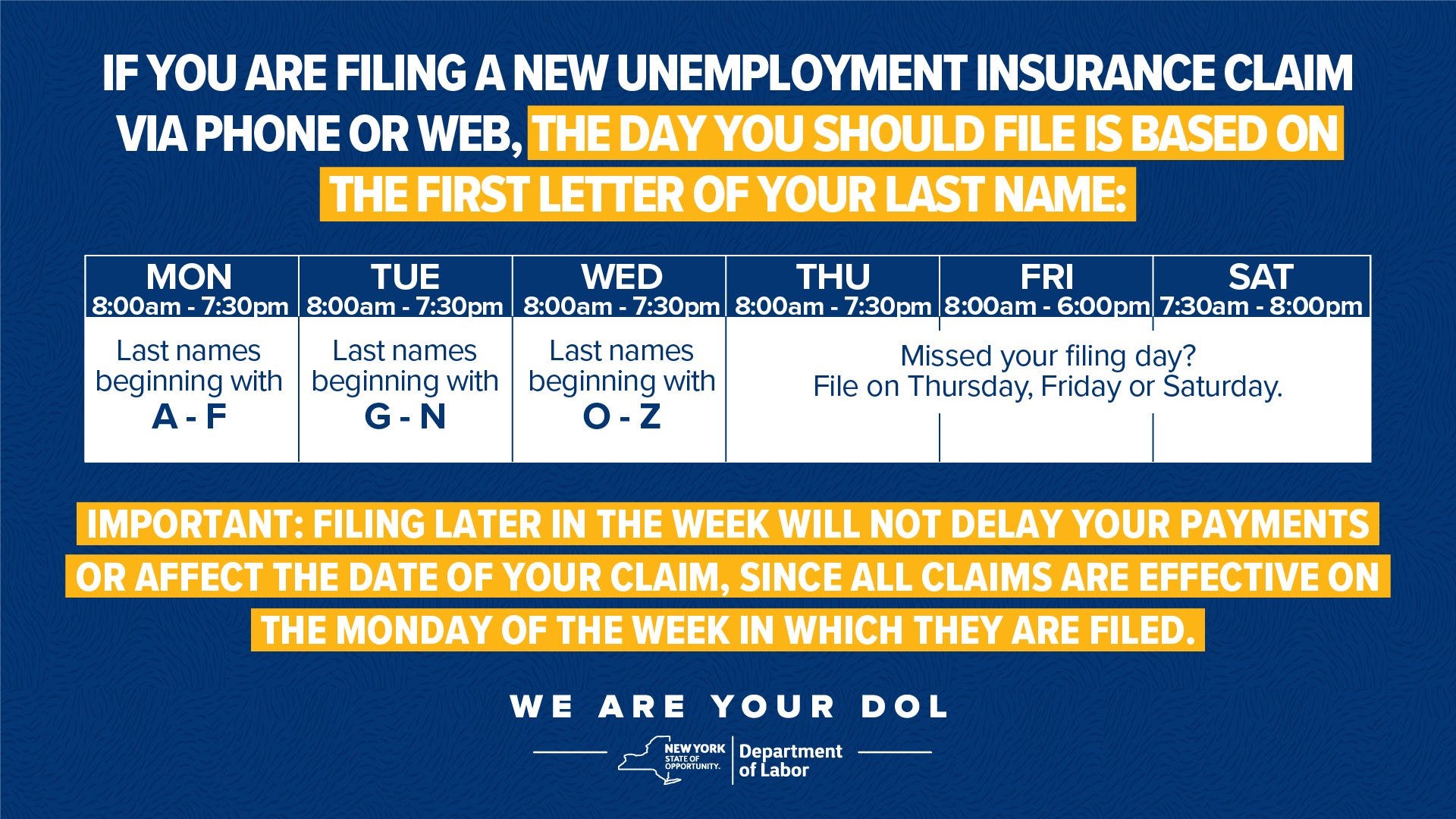

You Could Owe 1200 In Federal Taxes On 300600 Unemployment Boosts. Unemployment In CA Is Taxable. To do this you have to complete a Voluntary Withholding Request or Form W-4V with your state unemployment.

You can do the same thing with unemployment income. If you didnt withhold anything youll have to pay any taxes. The 19 trillion American Rescue Plan signed into law last week includes a welcome tax break for unemployed workers.

Up to 20 cash back How much youll owe your state varies. Any money that you receive is subject to federal or state tax or both. Some states like California dont tax unemployment compensation but others like Massachusetts do says Rob Seltzer a Los.

Ad two states only tax a portion of unemployment benefits Indiana and Wisconsin. To help offset your future tax liability you may. The law waives federal income taxes on up to.

To stay on top of this issue you should adhere to your Form 1099-G which you will receive from the IRS in the mail that will tell you how much you must report in. It depends on what state you live in. If you live in one of the.

The Case For Forgiving Taxes On Pandemic Unemployment Aid

What Are Employer Taxes And Employee Taxes Gusto

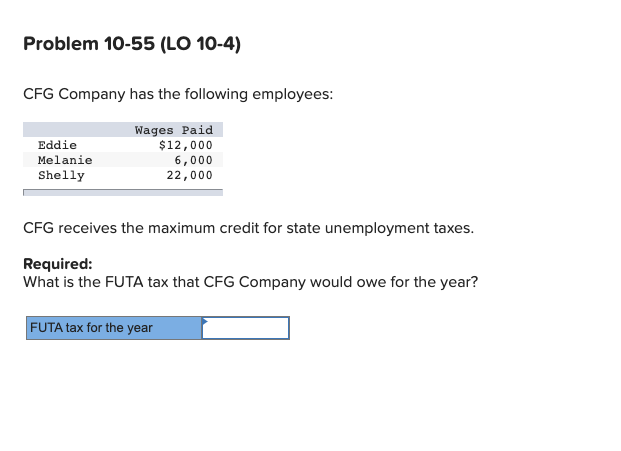

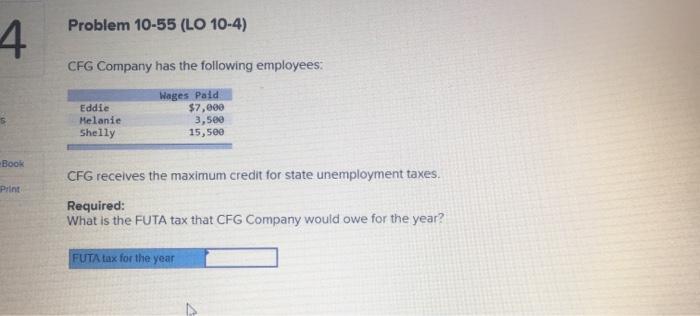

Solved Problem 10 55 Lo 10 4 Cfg Company Has The Following Chegg Com

How Unemployment Benefits Can Affect Your 2020 Taxes

Solved Problem 10 55 Lo 10 4 4 Cfg Company Has The Chegg Com

Unemployment Compensation Is Taxable In Arizona With One Exception

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

What Is A 1099 G Form And What Do I Do With It

Bill To Exempt State Taxes On Unemployment Benefits One Step From Governor S Signature Talk Business Politics

Beware Of The Unemployment Benefit Tax Bite What You Need To Know

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

I M Unemployed And Owe Back Taxes What Should I Do Wiztax

How Are Unemployment Benefits Taxed

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Are Unemployment Benefit Payments Taxable At A State And Federal Level 1099 G Forms How Much Do I Have To Pay Based On My Withholding Aving To Invest

States That Borrowed From Feds To Cover Unemployment Comp Checks Are About To Owe Interest New Jersey Monitor

Texas Is Underfunding Unemployment To Keep Business Taxes Low Now It Owes 7 Billion And Counting Tpr

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back